The rush to implement “change” in the next 100 days will be irresistible and the need to break up Labour’s manifesto to protect painful taxes on pensions, savings and “wealth” held in assets will play out.

These are the days when the books will be opened and it will be found that there is no money left. But the books are already completely open and transparent, so the discovery of imaginary black holes in the public finances will not wash.

But Labor can escape that predicament by finding instead that their spending needs have been undervalued and therefore new tax-raising plans are urgently needed.

If there’s one thing Labor has in abundance it’s appetite, and it will certainly find ways to justify more taxes.

In the state of public support following the defeat of the Conservatives, the public could be forgiven for being upset about what Labor said in the six weeks or so of the general election campaign.

Labor politicians have repeatedly contradicted each other on tax policies, and when pressed for a direct answer would reply that they had “no plans” to raise taxes beyond those already announced , which almost certainly meant the opposite.

This confusion was deliberate and the inability of any media pundits to nail Labour’s economic gel to the table will, as always, have provided a huge opportunity to bring in higher taxes that Denis Healey could only dream of.

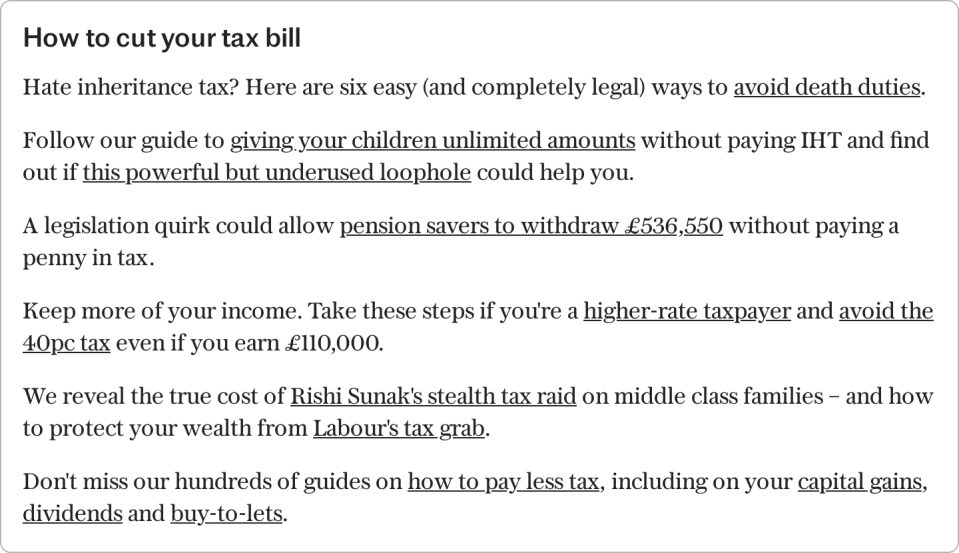

During the election campaign, Labor refused to rule out changes to capital gains tax (CGT).

Given the views of many aggressive high tax campaigners who are now Labor MPs that GST should be used as a proxy for a wealth tax which they have not been averse to publicly advocating, we can expect a significant expansion of the application of GST and on the rise. of the rates at which it is charged.

Even Her Majesty’s Revenue and Customs (HMRC) has said that a rise in VAT rates could result in a £3bn drop in the tax revenue it generates, as people could be expected to decide not to sell assets that would be charged high tax on them.

However, existing transactions are likely to pick up, so income is likely to rise, before falling as people choose to hold onto existing assets such as shares and buy-to-let let rather than sell and face a tax bill.

GST is an extremely poisonous tax because the tax “gain” is often no more than inflation, with no intrinsic improvement in value.

Politicians who support policies that lead to inflation, taxing you on any gains it creates in assets, are punishing you for their errors by ensuring that you cannot protect yourself from their inflationary policies.

The most consistent demand from Labor’s high tax advocates is to increase CGT rates to match those of income tax and make it chargeable on death as well as inheritance tax.

This would result in the gain on the properties and other assets being taxed twice, first for GST and then for their contribution to the estate.

This additional death tax is being promoted by Labour’s think tanks, the Resolution Foundation and the Institute for Public Policy Research (IPPR), while tax watchdogs, the Institute for Fiscal Studies (IFS), calculate that it would increase a further £1.6bn to date. into our overburdened, low productivity public sector.

The current inheritance tax threshold – which the Cameron-to-Sunak Conservatives have stubbornly refused to raise, let alone abolish, is likely to remain. Labor could afford to raise it but still increase total death tax revenue by adding CGT.

Those with taxable property now, or from an inheritance, will experience the pain in the next four or five years. It was only three years ago that Sir Keir Starmer said: “We are looking precisely at… property income, dividend income, stocks, shares etc… all those options are a wealth tax in the broadest sense of the word. “

Lisa Nandy, the shadow international development minister under the previous government, also said: “We should at least bring wealth taxes in line with income taxes – we go after the wealth… wealth is in assets and that’s where we will start. “

Labor has said it will not target working people and regularly describes income from property sales or rents and the sale of equity as unearned income – so the chances of raising the tax rates on these.

When pressed, Angela Rayner refused to even apply the CGT exclusion to the sale of family homes. The freeze on fuel duty, and the end of the preferential tax treatment for pensions, were not lifted, despite repeated questions from journalists and interviewers.

The 25pc tax-free pension allowance could be scrapped despite thousands of people having invested in their pensions on the basis of a promise from the state that they can withdraw 25pc tax-free, and taxing the another part.

And then there is council tax – which looks set to be turned into local wealth taxes by Labor changing council tax bands and even devolving increased taxing powers to local governments.

By changing council tax so that a greater share of the tax comes from owners of more expensive properties, Labor can claim they are helping councils fund their services without centralizing their own spending .

This would change the purpose of council tax from funding the use of local services through the likely size of a household to a sharply progressive punitive tax on more expensive properties. Tax bonds may change or more may be introduced, but the end game is much higher property taxes.

By the end of the first 100 days, the pain from higher taxes will be palpable. The tip of the iceberg in the announcement will have given no hint of what lay beneath – but no one can say they weren’t warned.