In this new series, Telegraph Money finds out how people are spending their tax-free lump sums. If you accessed your pension in your 50s, we’d love to hear how you used the money – please email money@telegraph.co.ukand a journalist will be in touch.

Mention the word “pension”, and many people’s thoughts will drift to their tax-free lump sum.

After years of hard work, that brand new sports car, Caribbean vacation or early retirement can move from dream to reality overnight. Others may see the opportunity to finally help their children financially, or make those home improvements they’ve been waiting years to make.

For Roger Hipwell and Pat Walker, it was five.

The couple started investing in the late 1980s when James, now a colleague and family friend, started a business as a financial adviser – they were his first clients.

“I had some money and I think I sold a flat in Old Windsor. Remember this was 1987, three months before the big crash. We invested in unit trusts,” says Roger.

“Within three months, I think I lost half of it. However, within 12 months it had come back up. I intended to retire earlier than my father did because he did not enjoy his retirement.”

Roger stopped working in 1995, aged 50. He took a small pension, together with his lump sum of around £45,000, and bought a boat for £9,000. He also took up lobster fishing, although he says it was difficult to make money because of hunger within the family.

Pat says: “It was my thesis on Friday night.”

He is now 79 and Pat is 77. They have been together for 40 years and married for 10, meeting on an IT sales training course while working with rival companies.

Pat says: “Roger was a sales manager, so his sales people were competing with me. Conversations often took place in the morning: ‘Where are you until today?’, ‘You have no business’.”

After that first investment, they used James’ advice to take advantage of the new products such as self-invested personal pensions (Sipps) and ISAS that emerged during the 1990s.

At first, they lived in Reading and had a holiday home. When Roger retired, they bought a cottage in Orford, Suffolk, eventually selling the other two properties. Another part of his lump sum went into the substantial building work required on their new “abandoned” purchase.

Before long, it was Pat’s turn to retire, and fulfill a lifelong dream with her own £55,000 lump sum.

“All my cars were Minis, and I always wanted a sports car. We picked and asked which sports car to get, and just as we were going through that process MG announced the MG F – so I bought one of the first cars, in racing green. I really enjoyed it. Two nice little seats, no room for any luggage.”

After the two “hung up their documents”, they decided to spend more of their lump sum on moving to an unusual location – the other side of the garden.

Pat says: “One of my interests in life is architecture. We had to move from the cottage because it was very small. I was driving back to Guildford and I thought, we’ve got a big piece of land. Why don’t we see if we can build a house there?”

Roger says: “When we bought the cottage, the estate agent negotiated that we would have two thirds of the garden from the cottage next door. We went for planning permission and surprised everyone by getting it, and we built the house.”

About 10 years later, they reached an age when it was time to downsize. They sold up, bought a new property and rented out elsewhere and further renovations were completed.

Pat says: “We always knew we had to move because it was a house that had never been lived in. When a bungalow came up, we decided that if we didn’t do it then we might get too old to move.

“We renovated this one. I guess you could say our lump sum went into the builders’ pockets. It’s good that we were able to do this. We never felt uplifted.”

As a result of the downsizing, money was to be given to Pat’s son and daughter.

Roger explains: “Indirectly, it’s a benefit of the lump sum. We used part of the lump sum for the building work, so effectively when we sold it [the house] they took advantage of it.”

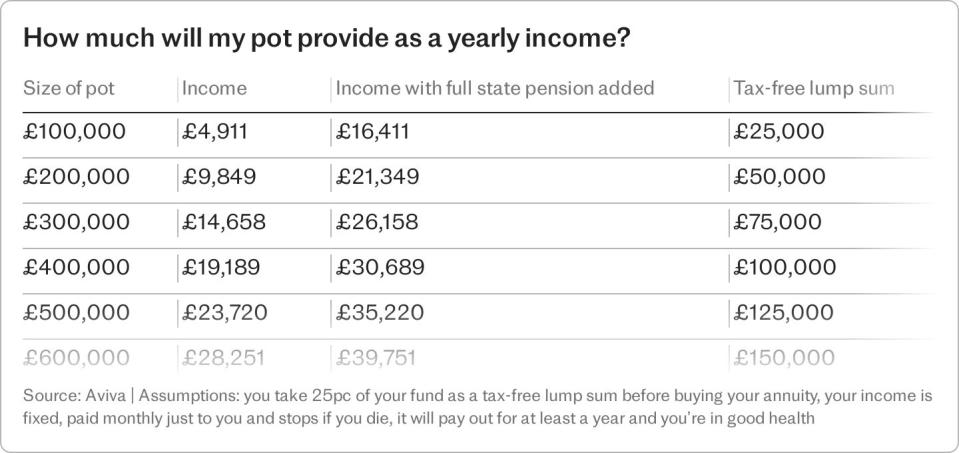

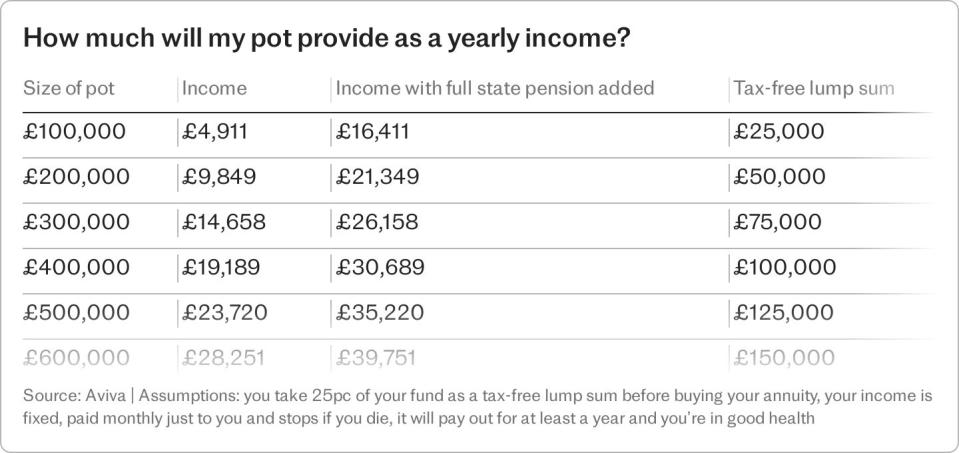

These days, they live off their state pensions and an extra £18,000 a year between them, which is drawn from Sipps and ISAS and is mostly investment income.

It makes life fair and peaceful. They vacation for free at friends’ houses in Crete and Barbados, visiting every year or two. They helped another friend start a bakery business by driving the van, working in the shop and putting their sales experience to good use. However, they do not give away all their business acumen.

“We now run a stationery company,” says Pat. “I’ve always been very interested in lettering and printing and paper et cetera.

“We sell through stockists a wide range of high-quality, hand-printed stationery. We don’t make enough to pay anything back into our pension. I do it because I love it.”