Dangerous territory, death taxes – and new chancellor Rachel Reeves is about to find out if, in her search for more taxpayer pounds, she decides to enter this political minefield.

“The art of taxation”, declared Jean-Baptiste Colbert, Louis XIV’s finance minister, “consists in plucking the goose to get the most feathers with the least amount of hissing.”

However Reeves is closing in, and there will surely be a loud outburst of hiss fiddling around with inheritance tax. However it is one of the sources of government income that the new chancellor has refused to tie his hands to, making it a counter-choice for uprooting.

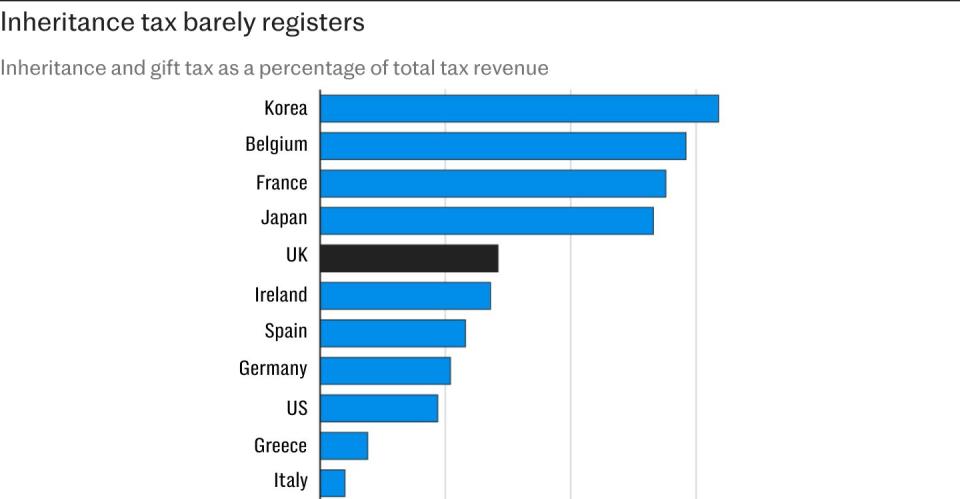

For that reason, the left-wing think tank Demos comes up with a 65-page report on inheritance tax reform that helpfully points out that all but one of the G7 economies raise significantly more from death taxes than we do here in the UK.

The exception is Italy, where the tax rate is very low and is only applied to estates over €1m (£840,000).

All the others, including the US, manage to get more than the UK, where only 4.2pc of the wealth transferred in the 2019/20 tax year was paid in tax. At just 0.7pc of government income, inheritance tax barely registers.

The temptation for Reeves must be all but irresistible. If we adopted the same system as South Korea, for example, the Exchequer could raise £6.5bn more a year in inheritance tax than it currently does, according to Demos, and another £2.5bn if adopted with the same approach. with lifetime wealth transfers.

The reform becomes more controversial because inheritance tax as it stands is widely seen as unfair. For the very rich, it is almost entirely avoidable, but for Central England, which is more caught up in the tax due to rising property prices, it is almost impossible to get around.

But just because it’s seen as unfair doesn’t mean it’s easy to reform. For example, there are good reasons for the exemptions for manual businesses and worked agricultural land, and not just because family businesses and farms are enterprises you want to encourage.

Much of the German economy is based on its mittel stand of small and medium-sized family companies that have been passed down from generation to generation. Would we have a similar thing here in the UK.

Imposing death duties on such businesses could put them at risk of going bust or making them commercially unviable. The same is true of farms, which could be uneconomic if they were forced to sell land to pay inheritance tax.

Some farmers have already been caught up in government-promoted reforestation schemes only to find that the reforested land is no longer exempt from inheritance tax.

The broader point of death duties, however, is that they offend something deep within the human psyche: the desire to accumulate the fruits of one’s labor or good fortune and pass them on to posterity or causes chosen.

It is in our DNA and no amount of political morality or social engineering has banished it. Death duties are a tax on wantonness, pure and simple. They are also a form of double taxation, since in most cases they are levied on money that has already been taxed.

It’s amazing, you might think, that it’s one of those taxes that many people think they might have to pay even though a relatively small percentage of estates actually do. So there is usually a political demand for raising the levels at which the tax becomes payable even though only a small number of them are benefiting from it.

Conversely, Reeves would undoubtedly lose votes by trying to lower the threshold; many more people would think they were held accountable than they actually are.

Ken Clarke, a former chancellor, once said that he gave up on tax reform after realizing that whatever he did would create winners and losers, and that he would be politically punished by the losers without getting any credit from the winners.

Reeves may be about to learn this lesson the hard way when it comes to inheritance tax. Despite the fiscal pressures to raise more taxes, she is well advised to proceed with caution.

There is no doubt that as currently constructed, the British system is a very bad tax. As Chris Sanger, head of tax policy at EY, says: “If the system was designed from scratch, you wouldn’t start here”.

The simplest solution is to abolish the tax entirely, which the last Tory government finally intended – but that is clearly not going to happen under Labour.

There are some jurisdictions, such as Singapore, that never had the tax in the first place, but outside of low-tax havens like this thriving city-state, it’s hard to find an economy that doesn’t have any form of inheritance tax at all.

It is true that there is no such inheritance tax in Canada, Australia and Norway, but in all three jurisdictions recipients of passed-on wealth are liable to step up capital gains, when they inherit an estate or dispose of assets. This could reasonably be seen as much the same thing.

It is also true that in most OECD countries the tax is levied on receipts, rather than the estate. This has always struck me as a better structured approach. What all these systems have in common, however, is that they are extremely complex, subject to quirks, and widely seen as unfair.

Some, however, are more progressive than others; There is no doubt that Labour’s redistributive aims will guide the redesign of the British system, a system which the Government could combine with some form of ongoing wealth tax.

If Reeves were to be truly radical, she could even replace inheritance tax with a lifetime wealth tax.

Whatever she does, she must first understand that all wealth taxes often have very harmful behavioral consequences. Surprise – usually they would not help at all to create wealth, to grow and therefore ultimately to grow the tax base.

Already, we see some of those consequences with the proposed abolition of the tax breaks for non-fields. Many non-doms are voting with their feet. It will be the same as inheritance tax. Throw down the wealth too hard and it will just go somewhere else.

In today’s world, capital is highly mobile; it was quite difficult to raise feathers with a minimum of hissing in Colbert’s time. It is even more difficult today.