Figures provided by the world’s largest art auctioneers confirm that 2023 was a testing year for the art market, or, as Christie’s CEO Guillaume Cerutti said, balancing the disadvantages with advantages, a “paradoxical” year.

Sotheby’s emerged with £6.28&billion in sales, on a par with 2022. Topping its list is Picasso’s 1932 painting Femme à la montre, which sold for $139.3&million (£113&million) in New York. auction price of the year. Picasso’s annual auction sales fell from £454 million in 2015 to £436 million.

Nearby, at Sotheby’s London, was Gustav Klimt’s Bean le Fan, 1917-18, which fetched the highest auction price ever in Europe at £85.3&million. It was bought by art consultant Patti Wong, who outbid Taiwanese collector Robert Wu to buy the work for an anonymous collector in Hong Kong, no doubt attracted by the Asian art influences seen in the painting. As with most auctions, it is not clear how profitable these were as the proceeds were shared with third party guarantors – anonymous parties who supported individual sales before the auctions took place, resulting in a reward the process.

Christie’s came in second with sales of £5&billion, apparently unfazed by the loss of market share. But when he announced the company’s results, Cerutti took the unusual step of referring for the first time to 2022 when he would have a majority of market share, thanks to the extraordinary quality of the Microsoft co-founder’s $1.6&billion collection, Paul Allen. Cerutti then pointed to a 26 percent drop in sales compared to 2022, but only 7 percent, he said, if you took out the Allen collection – which, of course, he couldn’t.

Both companies now call themselves “art and luxury” auctioneers. For them, handbags, watches, wine and jewelery feature strongly alongside the Rembrandts and Picassos. Although individual prices of luxury goods may not be rising any more, the number of auction sales is still increasing. Cerutti made a big point this summer of revealing how luxury sales were outpacing art sales at Christie’s, and at the end of 2023 he could point to a £790million sale led by the diamond Bleu Royal, a rare vivid blue , 17.61-carat. Diamond, which was the most expensive jewel at auction last year at £32 million. Luxury goods are popular with Asian buyers and are the biggest entry point for new buyers at Christie’s, Cerutti said, with sales of handbags and watches in the Asia Pacific region reaching record totals last year. .

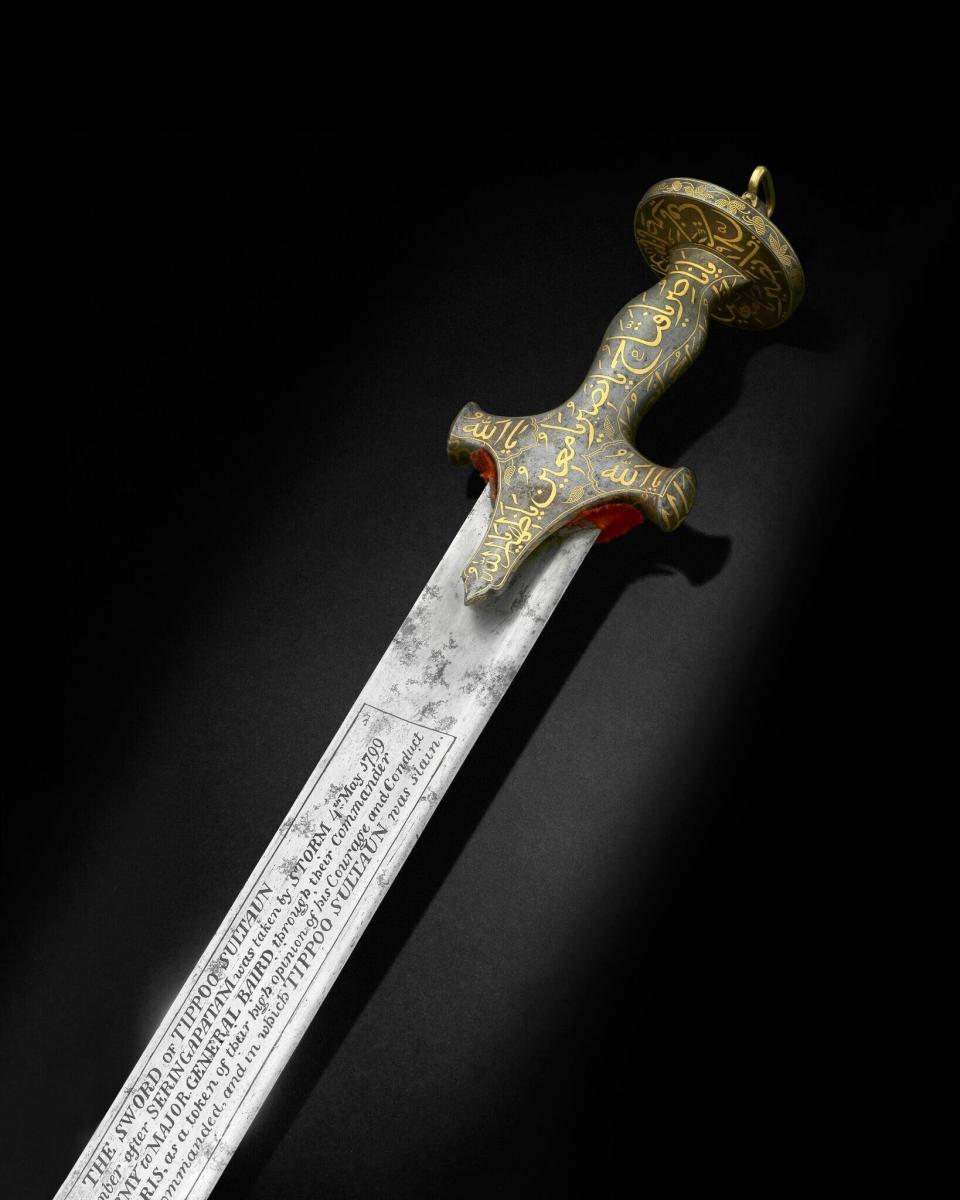

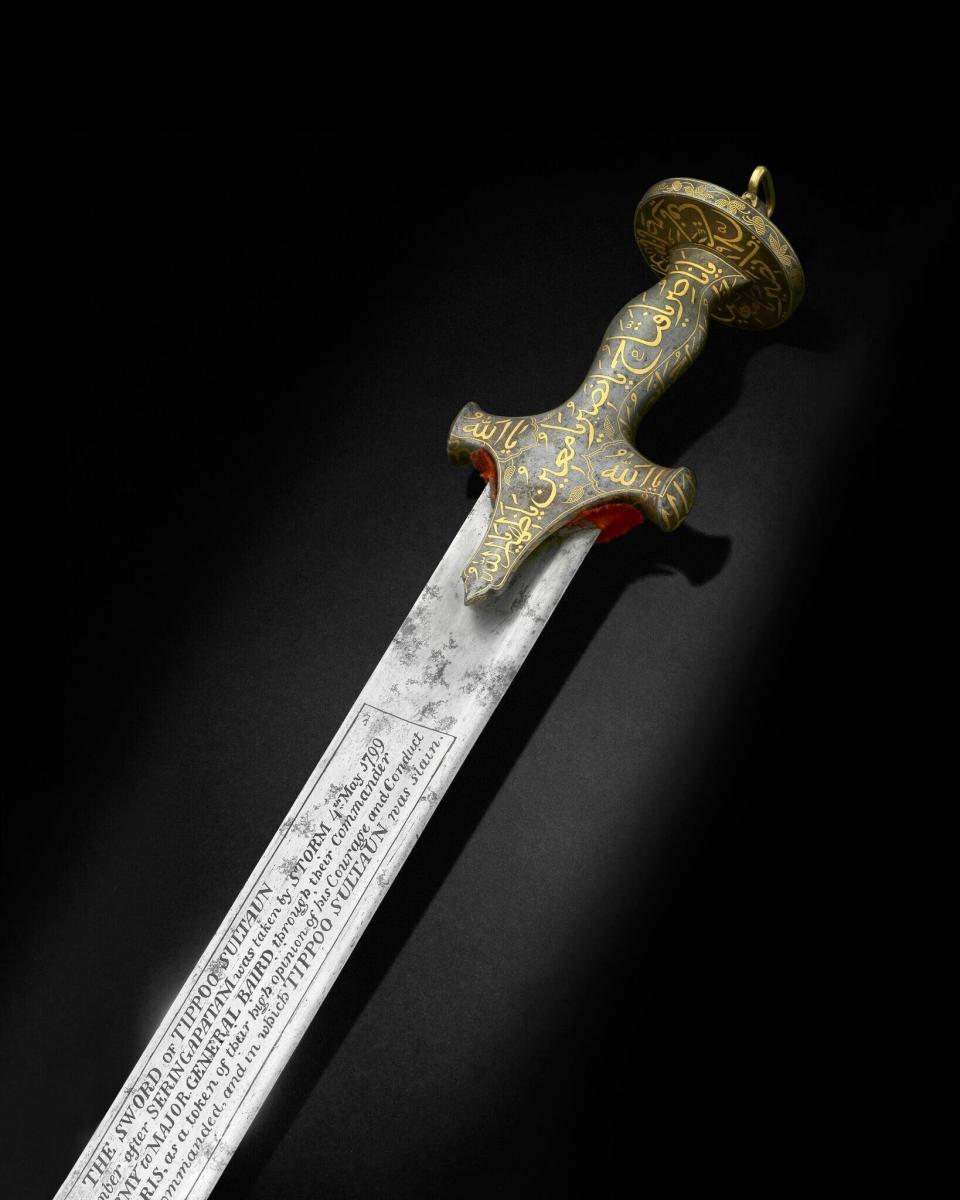

Phillips, which came in third, declined to reveal year-end totals, but highlighted its key areas of growth as jewelery (up 40 per cent) and design (up 45 per cent). On the other hand, fourth-ranked Bonhams, now with 14 salesrooms worldwide, was happy to announce a 14 percent growth in turnover last year to $1.14 billion, which must be running Phillips pretty close. He said the biggest growth in his Indian and Islamic art department was the sale of the Sword of Tipu Sultan Bedroom in the 18th century for £14 & nbsp; million – a world auction record for an Indian and Islamic object and the most valuable sword ever sold at auction.

The key art statistics were brought together by analyst ArtTactic which indicated that the “flight to quality”, which usually occurs when the market collapses, did not occur. Art auction sales in the main categories of old master, impressionist, modern and contemporary art at the top three auctioneers, Sotheby’s, Christie’s and Phillips, fell 27 percent in 2023 from 2022 to $5.74 billion. The underlying reason was said to be that there was a 30 percent reduction in the number of lots valued at over $10&million that were offered on the market.

On the other hand, sales of lower value lots under $50,000 each increased by 18 percent compared to 2022, indicating a more democratic market at work.

Looking at the categories, the impressionist market, which was also well represented in 2022 in the Allen collection, experienced the biggest drop in terms of sales volume, compared to individual values, a 53.4 percent decrease. Post-war classical and contemporary courses also fell sharply by 31.6 per cent. Sales of works by Andy Warhol, the bellwether of this market – whose Shot Sage Blue Marilyn sold for $195 & a hair over a million the year before – saw a 73 percent drop. Even the fashion-driven market for younger contemporary art, although buoyant on the surface, fell 12.8 percent. The best performer, ironically considering the amount of negative press it had, was the old master market inspired by rediscovered works by Rembrandt and Canaletto, which fell just 5.5 percent.

Down though they weren’t quite out there were NFT (non-mungible tokens), once called “tickets to a whole new lifestyle”. In July, it was widely reported that Bored Ape NFT, for which Justin Bieber paid $1.3&million in 2022, was worth 5 percent of that. they were once sought after for paltry three-figure sums at London auction rooms.

The glaring example of a price correction at the top end was the collection created by the late real estate tycoon Gerald Fineberg at Christie’s in New York, which was estimated as high as $230&million and sold for $153&million. Paintings by market luminaries such as Picasso, Magritte, Jeff Koons and Christopher Wool, valued in the tens of millions, all sold well below their estimates, heralding the arrival of a buyer’s market, which is not no longer controlled by ambitious sellers.

However, women artists continued to be sought after, from the baroque painter Artemisia Gentileschi, to the American painter Agnes Martin, and the 21st century British star, Cecily Brown, in the glory of a survey exhibition at the Metropolitan Museum of Art.

Young female artists have also narrowed the gap between their male counterparts. In the under 38 category, female artists were in the majority making up 34 of the top 50 auction prices.

It was also a good year for women of color. A burnt terracotta pot by Magdalene Odundo, bought in 1993 for £33 sold for £82,500. Meanwhile Odundo’s record rose to £533,400 in another sale at Sotheby’s.

One of the most watched areas of the market was the growth of Paris as an international center. During October’s competing fairs, London Frieze and Art Basel Paris+, the Paris auctions topped the London auctions for the first time realizing €218&million (£189&million) over London’s Frieze week sales of £156&million.

Here, artist/designer François-Xavier Lalanne’s 10-foot-tall bronze and brass Rhinocrétaire 1 (1964) produced a striking result. Combining art, sculpture and functional design and containing a desk, bar and safe within its armored folds, it sold well above its €4 million estimate for a stunning record €18.3 million.

The sale was a good year for animal art with character – David Hockney’s ceramic cats, for example, or Les Flamants, 1910, a group of pink flames on the bank of a jungle lake by the self-taught Henri Rousseau, which rose above the estimates. for $43.5 & hairsp;million dollars at Christie’s – a rare example of an outsider making the top 10 list of auction sales in a year.