Fashion and beauty are starting to make peace with Amazon.

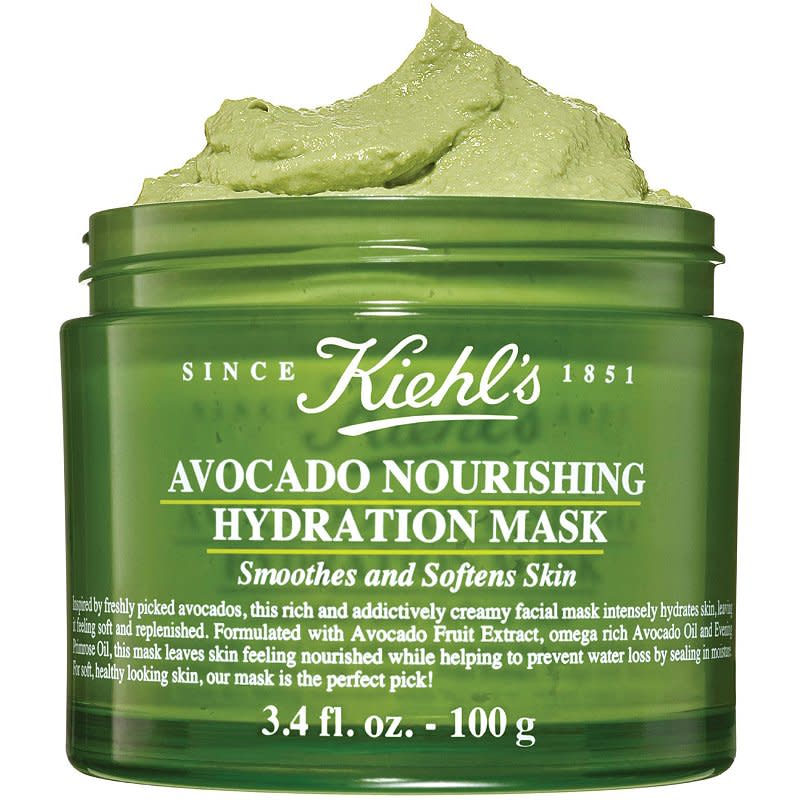

From Coach to Clinique, premium brands that have waited a long time ago are now looking for the platform. It’s the latest from Kiehl’s Since 1851, which launched on Amazon on Thursday.

More from WWD

The change is a recognition of two fundamental truths – that there are millions of shoppers on Amazon every day, and that many brands are already sold on the platform, either through direct relationships or through the gray market. But while many high-end fashion and beauty brands have embraced the platform, very few of the biggest luxury players have, despite the launch of the Luxury Stores section in 2020.

Regardless, Amazon continues to work to broaden its fashion appeal.

Amazon’s clothing, footwear and accessories sales totaled $56.4 billion in the US last year, according to an estimate from Coresight Research, which includes the value of third-party goods sold on the company’s marketplace.

That easily makes Amazon the biggest force in fashion — with consumer sales that are more than 90 percent higher than the $29.5 billion in gross merchandise value registered by Walmart Inc., according to Coresight. (Although Walmart has plans to grow its apparel business, CEO Doug McMillon told investors this month.)

Brands are still entering the Amazon ecosystem cautiously.

The Coach started under the ownership of Tapéis Inc. selling on Amazon in October, bringing one of the most accessible luxury shoes to the site, although Tapestry CEO Joanne Crevoiserat said the Coach Amazon trial is “pretty small.”

“Amazon is important,” Crevoiserat said. “We know that younger consumers search and find brands on that platform, and we wanted to put our best foot forward there.”

“We are pleased so far with the participation we are seeing. It’s small, but we’re happy with it,” she said.

The trainer is not alone. Hugo Boss, Tommy Hilfiger, Levi’s, Adidas, New Balance, Lacoste and Dr. Martens are all selling on Amazon, balancing the benefit of their humongous customer base with the risks of giving up a more direct relationship with the consumer.

Amazon shoppers are looking for more than just one brand, and prioritize cost and speed of delivery, an easy-to-use website and brand and product selection, according to Coresight. “More than half of Amazon’s apparel shoppers say they prefer Amazon.com because of its lower delivery cost and faster speed,” the firm said.

And Amazon has always worked to improve that experience through AI, AR, and virtual try-on features to personalize the shopping experience and build delivery capability and speed.

Simeon Siegel, equity analyst at BMO Capital Markets, expects to see more brands sign on with Amazon.

“At the end of the day — as D-to-C is a do-or-die conversation and as brands internalize that the right wholesale partners can be powerful partners,” Siegel said.

But he also had a word of warning.

“Too often in retail, the quality of the sale wears off long before the actual sale,” Siegel said. “Companies are looking for revenue that is bad for their business that will cost them more in the future than they will earn today. But the problem is that today’s dollar looks very attractive, even if it costs two tomorrow.

“Retail is a cycle of overextending revenue, giving it all back and trying to reset and re-grow the base,” he said.

After years of avoiding the platform in favor of their own sites, department stores and players like Tmall, the Estée Lauder Cos made a turn around in March and debuted Clinique on Amazon. More of the giant beauty brands are to follow this year.

On Amazon, Clinique sits alongside L’Oréal-owned brands including Lancôme, Youth to the People, IT Cosmetics, Urban Decay and Ralph Lauren Fragrance, as well as lines such as Keys Soulcare and Shiseido.

“They’re going to go where the customer is,” Olivia Tong, an analyst at Raymond James, said of Lauder’s change in strategy.

Tong said the new Lauder distribution is better positioned against competition from established multinationals and newer independent brands.

In its latest quarterly report, Lauder said Clinique’s debut on Amazon “significantly” exceeded expectations and contributed to the brand’s share gains.

Tracey Travis, Lauder’s chief financial officer, told WWD that the e-commerce platform has the potential to become an important center for the company.

“Amazon has a very broad consumer reach, and as we see channel dynamics continue to change in North America, it’s important for us to be able to reach our consumers wherever they want to shop,” said Travis, adding that various channels provide. different shopping experiences.

According to data from Market Defense, a consultancy that helps beauty brands sell on Amazon, there were 741,340 searches on the platform from the term “Clinique” in April. In the holiday period, before Clinique came in, there were about 1 million.

Vanessa Kuykendall, chief operating officer of Defense Market, thinks Clinique will be a beauty leader.

“A lot of brands are still watching and waiting to see big players and legacy brands make the transition,” said Kuykendall. “It’s really interesting that legacy brands like Estée Lauder have held back while being very innovative, maybe even indie brands, brands that are newer to the market after Amazon took over.”

Amazon also appears to be giving L’Oréal a boost. When Lancôme was put on the site last year, it found that 73 percent of consumers who bought a product were new to the brand, according to Ashley Helgans, an analyst at Jefferies.

Recently, L’Oréal Kiehl’s launched on the platform, with the goal of meeting customers where they are, according to John Reed, general manager of Kiehl’s.

And Nicolas Hieronimus, CEO of L’Oréal, told the audience at CAGNY in February: “Ultimately, there are distribution channels where many qualified consumers shop. I guess you are all Amazon shoppers…. The results are very good, in terms of perception, but also in terms of recruiting new consumers and that is very positive for the brand.”

If that’s true for premium beauty — and perhaps for accessible luxury fashion and accessories brands — pure luxury brands are still largely holding their own, even after Amazon expanded its Luxury Stores division to Europe two years ago.

Many European fashion and luxury brands had high hopes, but argue that Amazon has not lived up to its promises.

“In the beginning we felt very supported, and we were doing good business, but then it took off,” said one brand owner who spoke on condition of anonymity.

“I don’t know if they really understand fashion, and in my opinion they are not focused on building the business. We expected more support, and in the end we lost trust in them. We were banking on more loyalty, and they failed to deliver.”

Sally Singer, Amazon’s head of fashion in the United States, has left the company. The singer, former head of fashion direction at Vogue, joined Amazon in 2020, and is now president of Art + Commerce in New York.

She was closely associated with the designers and luxury brands, and acted as a bridge between the glossy world of high-end fashion, and the for-profit, algorithm-fueled Amazon.

The relationship between the European brands and Amazon has never been easy.

Brand managers said they were disappointed that the big name luxury brands from Kering and LVMH Moët Hennessy Louis Vuitton never came.

“There is no proximity to elevate the smaller brands that are already on the site,” said one current manager who asked not to be named. Another said: “We were hoping they would recognize the heavy brands, but so far they haven’t.”

Another company chief executive who asked not to be named told WWD that Luxury Stores made more sense in the United States because the wholesale market is smaller due to the closing of so many department stores.

An Amazon spokesperson said: “We continue to expand the selection in Amazon’s Luxury Stores and have added thousands of new styles this year alone. Fashion at Amazon has a diverse customer base and we are excited to make luxury goods more accessible to a wider audience. There is a growing interest among our customers in luxury products, especially beauty, skin care, fragrances, and pre-loved designer handbags and accessories. We will continue to listen to customer feedback as we bring more luxury items into our stores, including increasing our beauty and jewelry variety, and expanding ready-to-wear to include additional men’s styles .”

Last month, Amazon began selling luxury-owned streetwear through Hypebeast’s new HBX Archives store, giving shoppers on the website access to high-end names, but not directly from the source.

As luxury stands, it seems the rest of fashion is finally catching up.

“Customers are very expensive to acquire when you only have a direct channel, unless you’re a super brand you happen to be wary of,” said consultant Sonia Lapinsky, managing director at AlixPartners. “And so you look at, What’s the best and most efficient way to get these customers?

“Since the consumer is comfortable buying fashion on Amazon, it’s hard for brands to resist the exposure and sheer breadth of customer access they get from going on Amazon,” she said.

“I don’t think brands are blind to the realities of Amazon,” she said. “There are ways to get around some of the downsides to Amazon that we think the smartest retailers are getting [like] control your brand on the site…develop their own storefronts.”

That’s one more balancing act fashion companies have to pull off.

The best of WWD